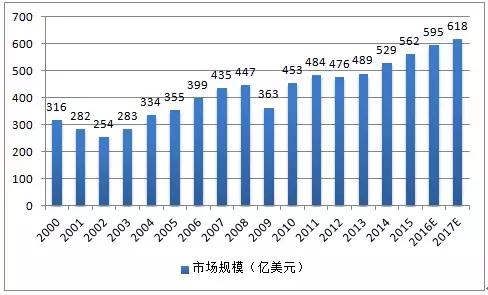

After 2010, the global connector market rebounded rapidly, mainly benefiting from the continuous development of downstream data communication, computer and peripheral, consumer electronics, automotive and other downstream industries. The global connector market demand continued to grow, and the market scale generally expanded.

How is the development of China’s connector market?

As of 2017, the global connector market has sales of US$62 billion. It is expected that the market will further grow to US$70 billion in 2018 and the compound annual growth rate will reach 4.2% in 2012-2018. In 2009-2018, the global connector market has a compound annual growth rate of 8.05%.

Worldwide connector market sales from 2000 to 2017 (US$100 million)

In 2017, connector manufacturers in the United States continued to maintain the top four, but the number of top 10 Asian manufacturers has increased significantly.

China’s Foxconn and Luxshare are in the top 10 ranks. The ranking is as follows:

- TE Connectivity

- Amphenol

- Molex Incorporated

- Delphi Connection Systems

- Yazaki

- Foxconn (FIT)

- JAE

- Luxshare

- JST

- Hirose

China’s connector industry is growing faster than the world

With the shift of the world’s manufacturing industry to mainland China, the focus of global connector production has also shifted to mainland China. China has become the world’s largest connector production base.

The overall level of connector manufacturing in China has been rapidly improved, and the connector market has expanded year by year. China has become the most promising and fastest growing region in the global connector market.

China’s connector industry’s compound growth rate in 2009-2017 reached 13.59%, much higher than the global growth rate of 8.05%.

2017 global connector market share

From 2003 to 2017, with the growth rate of China’s connector market significantly higher than the global average, China’s market size in 2017 reached nearly 20 billion US dollars, and its share has gradually increased from 20.9% in 2008 to 26.13 in 2017. %.

it has become the world’s largest connector consumer market, 20% more than the second European market.

The connectors produced in China are mainly low-end and high-end connectors, but the demand for high-end connectors is relatively low.

At present, the development of connectors in China is in the transition period from production to creation. The demand for high-end connectors, especially in the fields of automobile, telecommunications and data communication, computer and peripheral equipment, industry, military aviation, etc., has led to a rapid growth of the high-end connector market.

Among the top 100 electronic components in China, connector companies have entered the list from 6 in 2009 to 16 in 2017, and the total revenue of connectors in the top 100 has rapidly expanded from 3.8 billion yuan in 2008 to 63 billion yuan in 2017. Its compound growth rate in 2008-2017 is 30.54%, which is much higher than the compound growth rate of 12.51% in the entire electronic component industry.

With the internationally renowned connector companies represented by Tyco Electronics (TE), Molex, etc., the production bases have been transferred to China, and the manufacturing level of connectors in China has rapidly increased, plus China’s aerospace, aviation, electronics, and ships. The demand and investment of high-end connectors in the military industry such as ships are increasing. The connector technology of various downstream applications in domestic enterprises is close to or even reaching the international top level. It is represented by Lixun Precision, AVIC Optoelectronics, Derun Electronics, and Electrical Connection Technology. China’s high-end connector companies are growing rapidly, accelerating the domestic replacement of high-end connectors.

Operating income and profit double growth

China’s connector industry has a serious differentiation in 2017. Most of China’s connector companies are mainly low-end products and imported substitutes, with low added value, especially consumer electronics. As market competition intensifies, profit levels are declining.

However, emerging industries and high-tech products still maintain high profit levels, with the rise of smart manufacturing, industry 4.0, military-civilian integration, Internet of Things, Internet of Vehicles, 5G communications and other emerging fields and the high data era. For technology products, the requirements for connectors are increasing. These connector products and enterprises will still maintain good profit levels in the future.

Listed in China’s major connector listed companies:

The connector industry represented by listed companies is in sync with the development of China’s electronic information industry. The profit of the whole industry has grown steadily, and some corporate profits have declined, and some have grown substantially.

The gross profit margin of the connector industry varies according to the product differences of each company. The overall trend is stable. At the same time, the Chinese connector industry has attached great importance to research and development of new technologies, new products, new materials, new processes and increased R&D investment in recent years. The number of patents and intellectual property products is increasing, and the gross profit margin of these products is much higher than traditional low-end products. It contributes a lot to the profit level of connector companies. In the future, the profit level of Chinese connector companies will be stable overall.

- 5G communication rapid development

China is actively pursuing the construction of 5G networks, which means that a new giant cake is waiting for Chinese and foreign telecom equipment manufacturers to “cut the knife”. Many communication equipment manufacturers have already participated in the investment and testing of 5G, which means that the country has initially formed. Relatively complete industrial chains, including Huawei, Datang, ZTE, HiSilicon, Ericsson, Nokia, Siemens, Motorola, Shanghai Bell and other domestic and foreign telecom equipment manufacturers have launched commercial or pre-commercial products.

The core network, fiber optic cable, and wiring equipment benefit first, followed by access network equipment, followed by network optimization, test equipment, and network management software. The time series of terminals and operators benefited slightly, and value-added services and operation and maintenance services were provided. The business finally benefited.

The demand for connectors for 5G development has greatly increased. Demand for high-end coaxial RF connectors, RF antennas, fiber optic connectors, QSFPs, and high-speed backplane connectors is increasing.

During the “Thirteenth Five-Year Plan” period, the state will continue to increase support for the aerospace industry. With the advancing of manned spaceflight projects and lunar exploration projects, the Beidou navigation industry is booming and it is expected to launch hundreds of hundred stars. The current shortage of national defense construction in China determines that the future investment in defense construction will continue to maintain high growth.

- China continues to increase support for the aerospace industry

It is expected that countries in the fields of aerospace, military electronics and other fields will be expected to achieve a compound growth of 20% in the next 5 to 10 years. At present, China is accelerating the modernization of the military and the construction of information technology. The rapid growth of new equipment demand will make the market for military connectors expand rapidly.

During the “13th Five-Year Plan” period, the domestic military connector market reached 9 billion yuan annually. With the increase of state support for high-tech industries such as aviation, aerospace, information and transportation during the 12th Five-Year Plan period and the implementation of the national series of space programs, the demand for high-end electrical connectors in the domestic market will rise strongly. In 2011, the domestic military connector market capacity accounted for about 6% of the total capacity (by amount), and its sales amounted to about 4.3 billion yuan. It is estimated that the scale of China’s military connector market will reach 9 billion yuan each year during the 13th Five-Year Plan period.

- The demand for smart mobile terminals such as smart phones is stable

Smart products are thinner, higher performance, more features, and longer battery life, which will require connectors with smaller sizes, wider operating frequencies, and higher transmission speeds. In recent years, the fields of wearable devices and the Internet of Things have developed rapidly, and new requirements have been placed on the connector industry, especially for the FPC series.

In the context of the pursuit of light, thin, short and small designs for electronic products, the FPC market has broad prospects. In recent years, various high-tech electronic products have been used in large quantities, such as digital cameras, digital cameras, and car satellites. Devices, LCD TVs, notebook computers, etc., especially in the field of communication such as mobile phones, are particularly widely used.

- automotive and industrial connectors or open up new growth spaces

With the global restrictions on fuel vehicles, the development of new energy vehicles is very fast. Especially in China, becoming a new energy vehicle power has become a national strategy. The implementation of Industry 4.0 and “Made in China 2025” requires higher requirements and greater demand for industrial connectors. The automotive and smart manufacturing connector market will be the largest application mayor for connectors worldwide.

2017 connector application map

The automotive sector is expected to open up new growth spaces. The innovation of automobiles is mainly in automotive electronics. With the popularity of new energy vehicles, ADAS, driverless and vehicle networking in the future, the proportion of automotive electronics will continue to increase. The strong growth of automotive electronics will drive the penetration rate to increase. It is expected that by 2020, the penetration rate of automotive electronics will increase from 30% at this stage to over 50%.

Compared with the smart phone industry chain, the automotive industry chain is more closed, including TE, Molex and other occupying the leading position of automotive connectors. Domestic connector manufacturers are limited in intellectual property rights and patent ownership, and it is relatively difficult to seize the market. However, the prospects for automotive and industrial connectors are huge, and with the trend of domestic substitution, the opportunity for the Chinese connector industry is even greater.

The demand for the connector market is still growing. Due to the improvement of China’s intelligent manufacturing and the complete supply chain, the overall demand for the Chinese connector market is growing rapidly, leading the rest of the world. This trend is very conducive to China’s connector companies to become bigger and stronger, improve technology research and development and manufacturing levels. This is extremely important for the full realization of the goal of “Made in China 2025”, the enhancement of China’s scientific and technological level and the healthy development of the country’s economy.